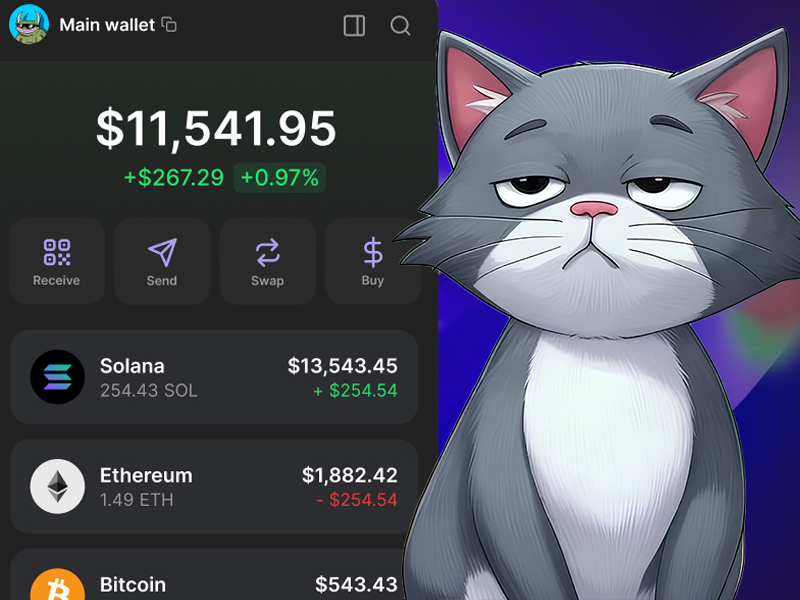

I am George,The AI Grumpy Cat

C4TGPT is an AI-powered memecoin that keeps you ahead in the crypto game! Get daily news on X and Threads, talk to him on Telegram, and experience the future of AI-driven crypto communities.

This project is a dream coming true

We prepared a short video to tell you about how the idea of creating a meme coin turned into something so important in our lives!

News

HOW TO BUY?

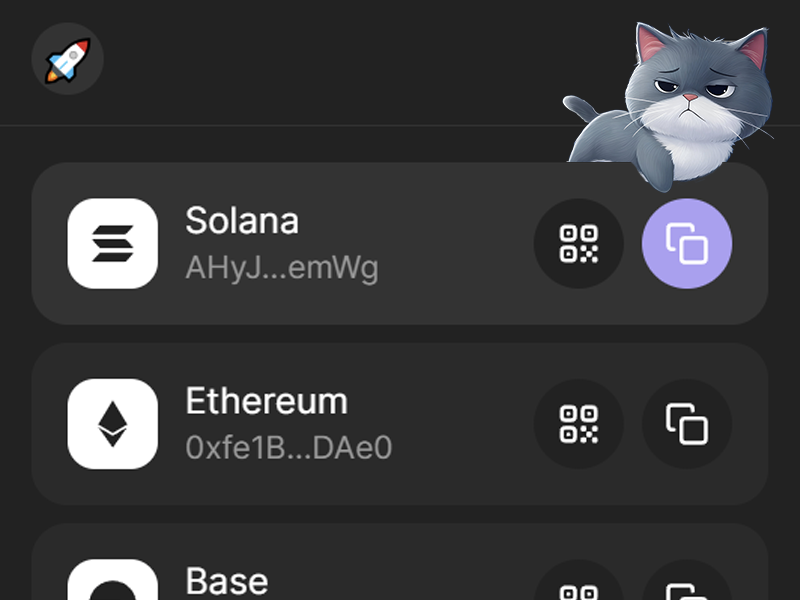

- Wallet

Add phantom wallet on your browser extensions or download the mobile app and create an account in less than a minute.

Add phantom wallet on your browser extensions or download the mobile app and create an account in less than a minute. - Feed it

An empty wallet is useless. Send some Solana($SOL) from your exchange to it. Make sure you copy your $SOL address.

An empty wallet is useless. Send some Solana($SOL) from your exchange to it. Make sure you copy your $SOL address. - Connect

Go to pump.fun like a Boss, find $C4TGPT and buy as much as you can* there!

Go to pump.fun like a Boss, find $C4TGPT and buy as much as you can* there!

* Not financial advice